Japan & Asian Fund Raising: Services and Process

Consulting

- Legal, Compliance, Tax

- LP Investor Perspectives

- Due Diligence Feasibility

- Organizational design succession planning, leadership

- Introduce and screen Japanese securities firms

- Negotiate Japan Partner agreement

- Monitor and communicate

Limited Clients

- Japan team works with maximum of 9 to 10 clients at one time

- No overlapping strategies

- Deep understanding of clients’ products and strategies

- Recruit “dedicated marketing professional” for more specialized coverage

Exclusive Mandates

- Client is represented on an exclusive basis

- Clients’ management and marketing team works closely with Japan or Asian based partners

- Investor road shows and Japan/Asian investor meetings are managed carefully as part of the marketing process

Marketing

- Time taken to understand investment firm, products, and goals

- Define marketing strategy

- Match client profile to shortlist of potential investors

- Organize road shows and meetings

- Collect feedback and follow up

Full Services licensed Partners

- Asian platforms are legally compliant with one or more licenses, including: Type I Financial Instruments Business; Type II Financial Instruments Business; Investment Advisory (IA); Investment Management (IM)

- Provide all front office and back office support, including client support, transportation, documentation/reporting, logistical support for Japan/Asian roadshows and conference calls

Professional Qualifications – international standards

- High caliber professional staff

- Background from leading Japanese and global financial institutions

- Strong relationships with key stakeholders at Japanese Pension Funds, Financial Institutions, and Retail HNW Distribution networks

- English, Japanese, Korean language expertise

- Deep understanding of investor needs

Client Satisfaction

- Independency from any financial or holding company

- Strict Vetting: By former institutional PMs and marketers

- Fund Concentration – 8 to 10 mandates at a time

- Engagement with a limited number of clients

- Credibility

- Success on Exclusive Fund Mandates

Investment Advisory and Consulting

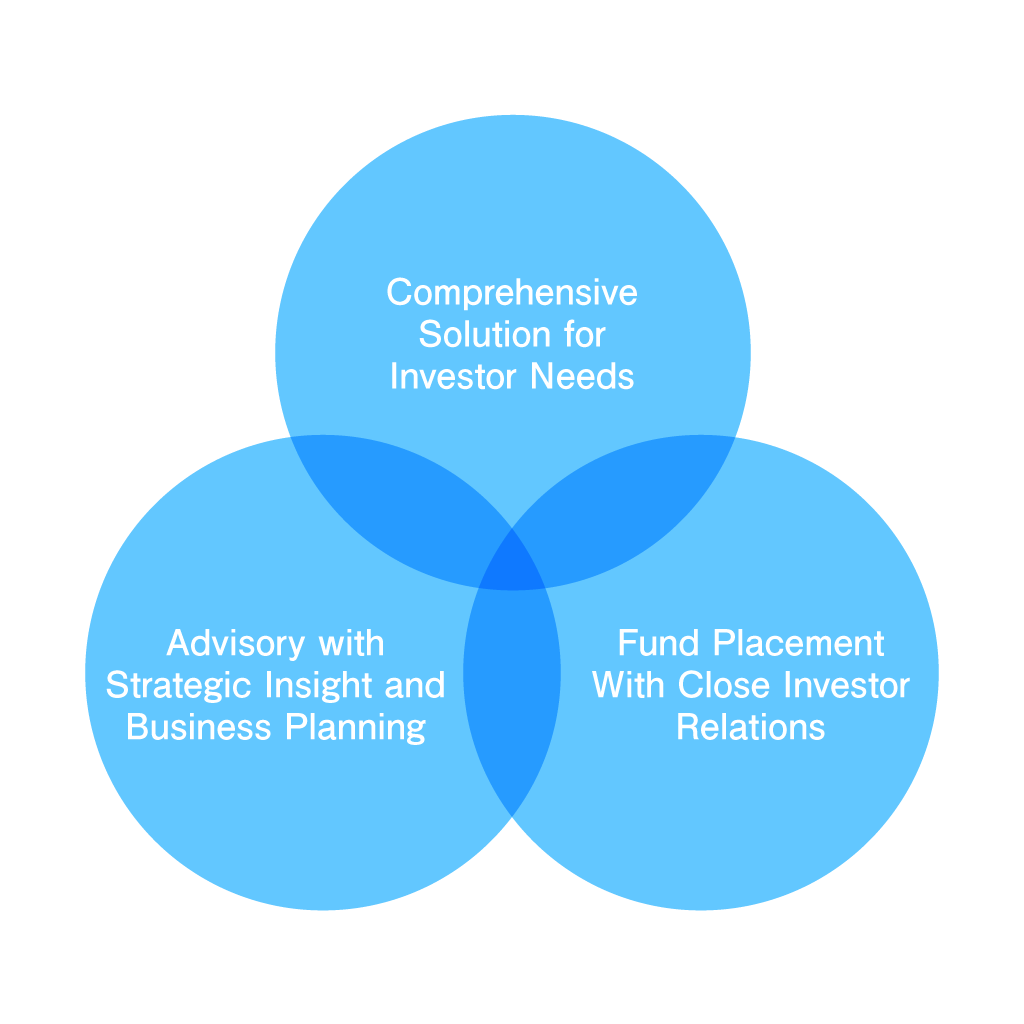

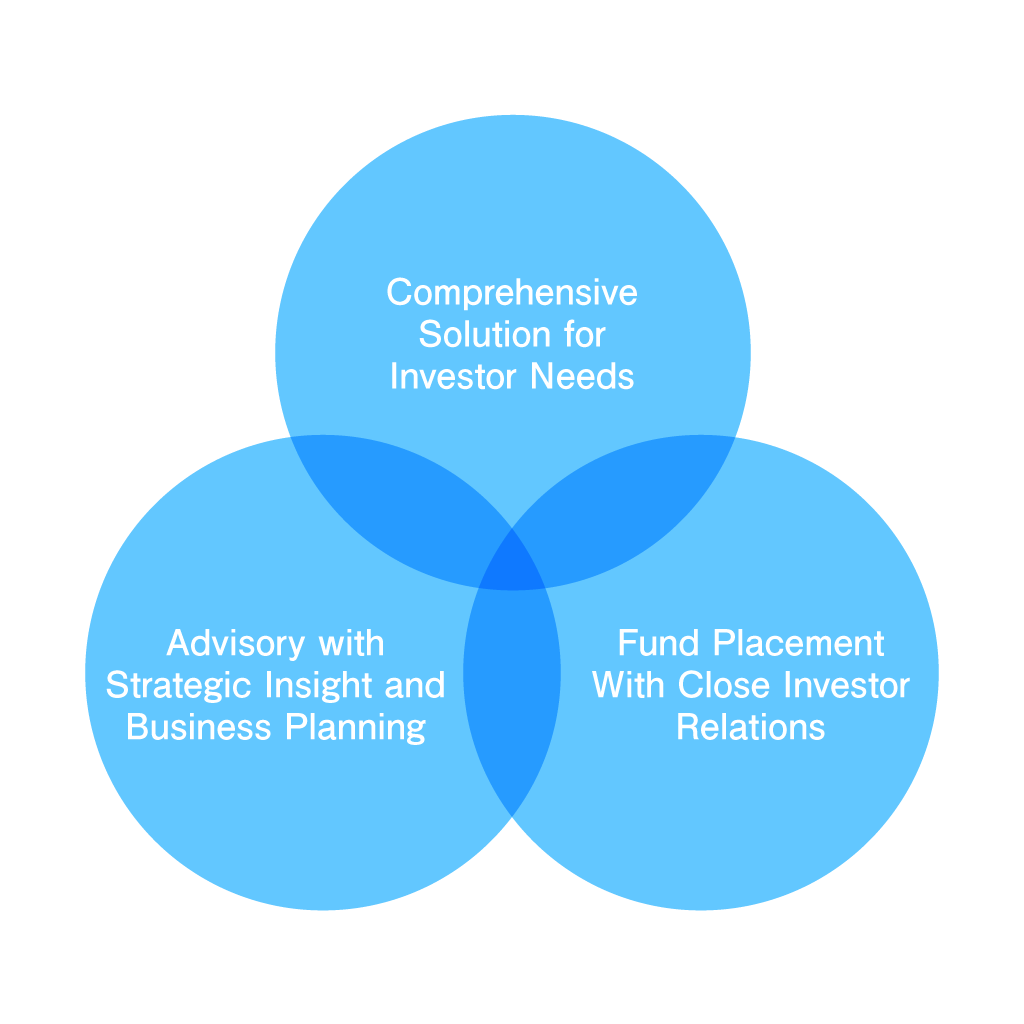

- Unification of 3 Dimensions:

- Comprehensive solution for investor needs

- Advisory/Consulting with strategic insight and business planning

- Fund placement/Distribution with close investor relations

- Relationship-driven, not Transaction-driven

- Experienced Team of 15 Professionals

- USD 1.5 Billion Raised